A Debit Balance in Manufacturing Overhead Means Overhead Was

On the other hand. Experts are tested by Chegg as specialists in their subject area.

Determine And Dispose Of Underapplied Or Overapplied Overhead Principles Of Accounting Volume 2 Managerial Accounting

In a job order cost system it would be correct in recording the purchase of raw materials to debit c.

. If the manufacturing overhead cost applied to work in process is less than the manufacturing overhead cost actually incurred during a period the difference is known as under-applied manufacturing overhead. Actual overhead cost was less than the amount of direct labor cost. B credit to Manufacturing Overhead of 68000.

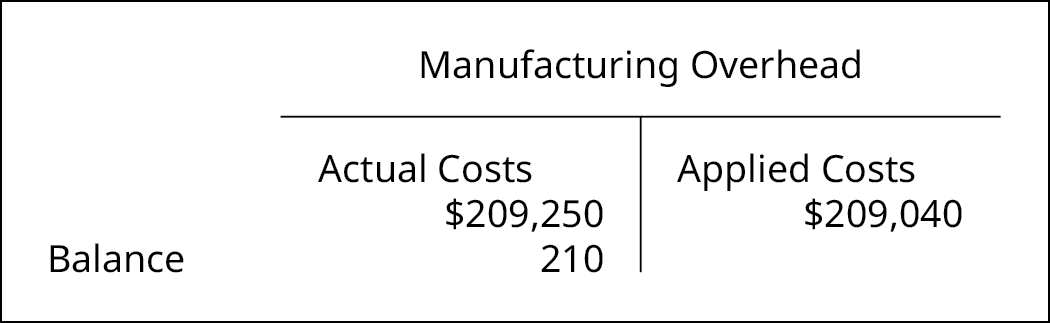

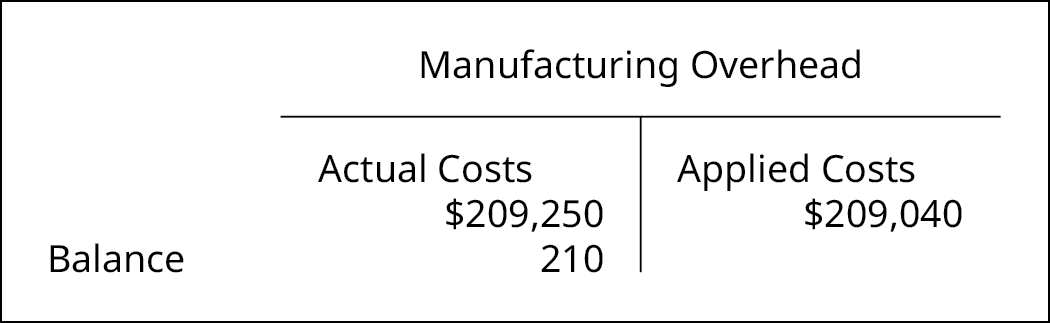

During October Beidleman Inc. Debit Balance for manufacturing overhead. More overhead cost has been charged to production than.

On the other hand if it shows a credit balance it means the overhead is over-applied. Printing of wedding invitations. A debit balance in the manufacturing overhead account at year end means that overhead was.

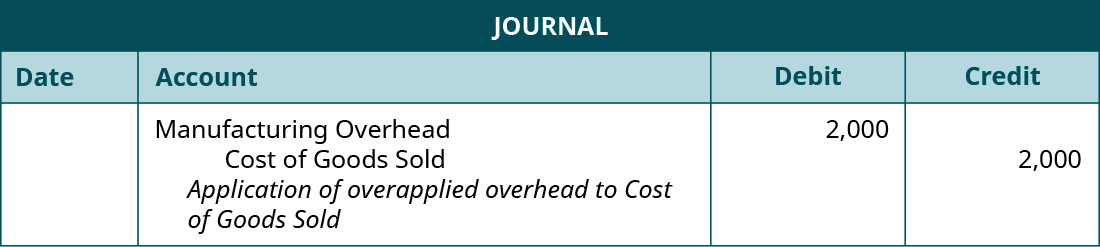

Actual overhead costs were equal to overhead costs applied to jobs. All actual overhead costs are debited as they are incurred and applied overhead costs are credited as they are applied to work in process. Up to 256 cash back At the year-end the adjustment entry needed to adjust the manufacturing overhead account balance to zero will include a debit to cost of goods sold.

Actual overhead costs were less than overhead costs applied to jobs. Actual overhead costs were equal to overhead costs applied to jobs. Terms in this set 13 Credit Balance for manufacturing overhead.

No jobs have been completed. D credit to Work in Process of 69000. Debit the work-in-process inventory account in a journal entry in your accounting records by the balance of the factory overhead account at the 22.

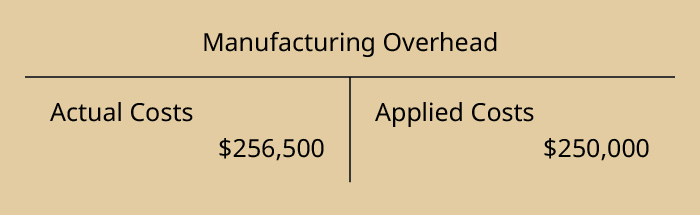

Actual overhead costs were greater than overhead costs applied to jobs. Who are the experts. Exercise 3-7 Underapplied and Overapplied Overhead LO3-7Osborn Manufacturing uses a predetermined overhead rate of 1910per direct labor-hour.

A debit balance in the manufacturing overhead account at year end means that overhead was underapplied. Ending Inventory Direct Material Used Direct Labor. Actual overhead costs were greater than overhead costs applied to jobs.

A journal entry that debits manufacturing overhead and credits accounts payable could be made to record. Labor costs charged to manufacturing overhead represent. Job Order Costing StudyLib.

It means you have incurred more actual manufacturing overhead costs than you have applied to your products ie. Manufacturing costs are generally incurred in one period and recorded in a If Manufacturing Overhead has a credit balance at the end of the period then 21. Actual overhead costs were less than overhead costs applied to jobs.

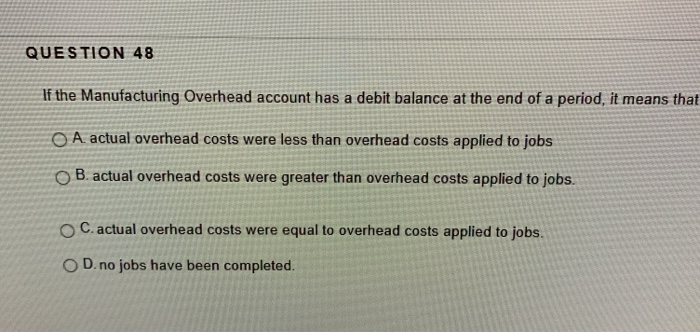

If the Manufacturing Overhead account has a debit balance at the end of a period it means that a. A process cost system would be used for all of the following except the c. - factory utilities expense.

Debit balance in the Manufacturing Overhead account at the end of the period means. C debit to Work in Process of 69000. Transferred 52000 from Work in Process to Finished Goods and recorded a Cost of Goods Sold of 55000.

Underapplied Overhead Definition A debit balance in the Manufacturing Overhead account that arises when the amount of overhead cost actually incurred is greater than the amount of overhead cost applied to Work in Process during a period. A debit balance in Manufacturing overhead means overhead was ____ underapplied. We review their content and use your feedback to keep the quality high.

The simpler method of closing out the balance of Manufacturing overhead is _____-closing it out to Work in process-allocating it among Work in process Finished goods and Cost of goods sold. If a company applies overhead to production on the basis of a predetermined rate a. A debit balance in the Manufacturing.

A debit balance in the manufacturing overhead account at year end means. Actual overhead cost was greater than the amount charged to production. At the end of a period if manufacturing overhead account shows a debit balance it means the overhead is under-applied.

Cost of goods manufactured. If the Manufacturing Overhead account has a debit balance at the end of a period it means that a. To eliminate underapplied overhead at the end of the year Manufacturing Overhead would be credited and Cost of Goods Sold would be debited.

No jobs have been completed. So here it means that the actual cost was greater than the applied cost. A debit to Manufacturing Overhead of 68000.

Actual overhead costs were less than the overhead assigned to jobs. Includes the manufacturing costs of goods finished during the period. TRUE If manufacturing overhead is underapplied during the year Manufacturing Overhead will need to be credited to bring the account balance to zero while Cost of Goods Sold would be debited.

If at the end of the year Manufacturing Overhead has been overapplied it means that b.

Question 48 If The Manufacturing Overhead Account Has Chegg Com

Determine And Dispose Of Underapplied Or Overapplied Overhead Principles Of Accounting Volume 2 Managerial Accounting

Determine And Dispose Of Underapplied Or Overapplied Overhead Principles Of Accounting Volume 2 Managerial Accounting

Comments

Post a Comment